Yet not, per financial could only provides ten% of the lending having lower-put holder-occupiers and you can 5% having reduced-put people. The dog owner-occupier allocation limitation is expected to increase so you can 15% in one Summer 2023. If you would like borrow as much as 95% of a home’s price, it’s most likely the lender will want your own put as discounts, instead of something special away from parents. Look at the twenty eight% rule, and therefore claims you to definitely mortgage repayments shouldn’t become more than just 28% of one’s pre-tax monthly money. For individuals who’re also uncomfortable that have nearly a third of your own income heading to the the home loan, you’ll want to avoid searching near the top of your budget.

Understand that the interest costs in the calculator is actually susceptible to change, which can effect on payment quantity. When the a variable price mortgage is selected, the interest rate will be susceptible to alter from the label of one’s mortgage. For a fixed rates mortgage, because the repaired speed period ends, the loan reverts so you can a varying price financing and you will payment number get transform. The brand new fees calculator doesn’t are all interest rates, charges and you will charges.

On the other hand, you will see greater credit strength for those who have low debt, sensible lifestyle expenses, a big deposit and you will adequate possessions. To use the borrowing from the bank electricity calculator, there are some trick pieces of advice you’ll need to find the most accurate guess of the number you would manage to use. Increasing your earnings is a wonderful treatment for improve your borrowing capacity. There are many different possibilities out of delivering a publicity, performing more shifts or modifying perform to help you leasing an extra room.

But not, before applying to own home financing, they intend to pull out an auto loan to exchange Alex’s dated one to.

Having month-to-month payments out of $eight hundred taken into account, their borrowing from the bank power drops to over $573,000. Its combined money is actually $150,100000 a-year in addition to their bills are estimated from the $fifty,000. Everything provided will not make up an offer from credit and you will will not be the cause of your own objectives, financial situation or individual things. We recommend looking to separate monetary, taxation and you may legal advice to test how information provided aligns with your private items.

- Building and you can insect inspections begin around $ and rise with respect to the size of your house.

- Your local Liberty Agent will be able to look at your lending products that assist you have decided the best advice.

- On one side, both you and anyone (or someone) you’re also applying having might have much more borrowing from the bank power – your own collective property, deposit and you can money setting you happen to be able to use a lot more than simply one applicant.

- The proprietor-occupier allocation limitation is expected to rise in order to 15% from one Summer 2023.

- Of a lot very first-day people think that once they reach its discounts mission, protecting a mortgage is not hard.

Overall performance don’t show, rates, pre-certification for the device or an offer to provide credit. Information including rates of interest cited and you will standard numbers included in the new presumptions is subject to change. These estimates are derived from the brand new claimed prices on the specified name and you will loan amount. Genuine repayments depends upon your circumstances and rate of interest transform. For lenders, the beds base standards tend to be a great $500,000 loan amount over three decades.

Pay down any current bills.

Financial eligibility, borrowing from the bank energy, and you may deposit requirements will vary based on private economic things and financial rules. I encourage consulting a licensed large financial company, economic advisor, or financial to own customized information before you make any economic behavior. Fico scores are impacted by and then make repeated programs to loan providers or credit team. But obtaining a new, similar-measurements of mortgage each year roughly is fairly normal and you can unlikely for people impression after all. It’s regular software for things such as large home loans, credit cards, store notes, vehicle fund and personal finance that may reduce your credit history. That’s because works out you do not getting handling your profit well.

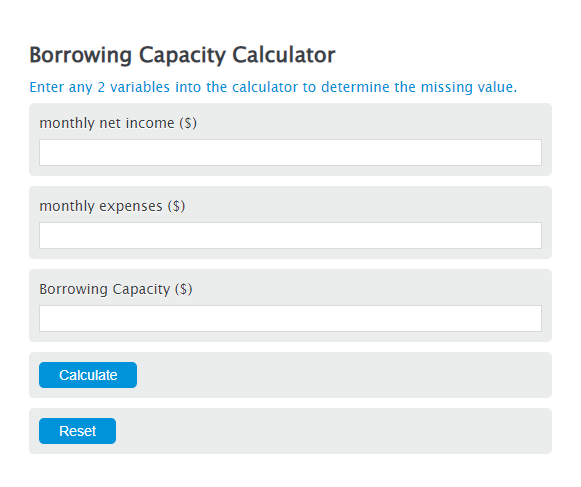

Need to find out how far you could acquire? Play with all of our calculator to locate the borrowing capability within the a matter away from seconds.

Some of the most popular reasons borrowing from the bank ability are lower were expenditures one to exceed money, a lot of an excellent personal debt, overlooked payments, a woeful credit score otherwise discouraging money government. Including, they could give increased amount borrowed for many who’lso are paying down they more than an extended label since your home loan money was smaller. Just in case you decide to go to have a varying interest rate loan more than a predetermined rate loan, they’ll are a buffer (in australia, normally in the step three% greater than the rate they give). But not, out of 2025, loan providers could possibly get forget HECS or other education loan repayments for individuals who’lso are alongside settling your debt.

The new Reserve Financial’s mortgage-to-really worth ratio (LVR) laws and regulations imply you always you would like a deposit one to’s at the very least 20% of the property’s really worth for a home you’ll reside in. To have a good investment property it goes up to help you 40%, however this is likely to become 35% from one Summer 2023. The fresh financial obligation-to-income (DTI) limitations from the Set-aside Financial are expected a while once February 2024.

Since the a different program, mortgage loans.co.nz makes it easier for you to get the mortgage you need. Fool around with all of our Studying Center, hand calculators, rates of interest advice and you may book Mortgage Take a look at app to plan an excellent easier, smoother travel towards your property ownership mission. Once you’ve delicate your financial allowance and you may reviewed your own borrowing from the bank strength – It’s now time for you to think about the form of financial most appropriate for you plus members of the family.

Initiate a discussion which have a great banker

Determine payments, rates to see exactly how much borrowing from the bank strength you actually have. YourMortgage.com.bien au will bring standard guidance and you will analysis characteristics in order to build advised monetary behavior. Our very own services is free for your requirements since the i receive settlement away from device company to possess paid positioning, ads, and you will suggestions. Importantly, these types of industrial matchmaking don’t determine our article integrity.

Financing Field representative are working along with you to know your state and you may needs and you may strongly recommend lenders which can be right for you. They can along with help you get pre-acceptance out of your selected bank to deliver confidence and a good competitive border when designing a deal. Qantas Issues are not awarded should your mortgage is within arrears otherwise default, otherwise some of the consumers are becoming pecuniary hardship recovery otherwise guidance at the time of crediting the brand new items.

Remember that our borrowing electricity calculator brings only an imagine and does not make sure that you will end up accepted for the amount. For every bank features other credit standards, and then make the condition novel. For repaired rate fund, pursuing the fixed price name, a varying rates usually pertain. Usually, their borrowing strength are determined as your net gain without your own expenditures. The expenses will likely be influenced by things like how many dependents on your own members of the family, any current house or consumer loan costs or any other monetary responsibilities such as private health insurance. More direct the important points your go into the fresh calculator, more sensible your own estimated credit ability may be – so you may should start with information the expenses.

The fresh borrowing electricity calculator in this post is just made to indicate what you are able borrow – you will only understand the correct matter if you get pre-acceptance to have a mortgage. Evaluation cost for variable Interest Simply fund are derived from an enthusiastic very first 5 year Attention Just several months. Research prices for fixed or secured Attention Only financing is centered to your an initial Desire Simply period equivalent in total to your repaired or protected several months. The quantity a financial try ready to lend is actually sooner or later right up to their discernment, but fundamentally relates to thinking about their money once costs and financing money. It then spends that it contour so you can determine how big out of a great financing you can provider from the latest rates (along with a shield out of ~2-3%). Everything available with YourMortgage.com.au is standard in general and will not make up yours expectations, financial predicament, otherwise needs.

It borrowing from the bank relationship is federally insured because of the National Borrowing Union Management. Versatile and you will personalized accounts to simply help control your every day funds. Evaluate the fresh details of one financing against some other to make the proper options. Certain points will be designated because the promoted, searched or sponsored and may also come conspicuously regarding the dining tables regardless of of the characteristics.